Financial services firms around the world face strict regulations around disclosure compliance and monitoring. For example, the Australian government mandates that financial Statements of Advice (SoAs) include disclosures covering conflicts of interest, own-product recommendations and more. Each disclosure, in turn, may contain a dozen or more sub-components. This adds up to a major burden for the service provider. On average, globally, financial firms dedicate 10-15% of their workforces and spend a combined $270 billion on regulatory compliance annually. New Regulatory Technology solutions can help financial services firms lower the costs associated with disclosure compliance monitoring and reduce their non-compliance risk. Here’s how.

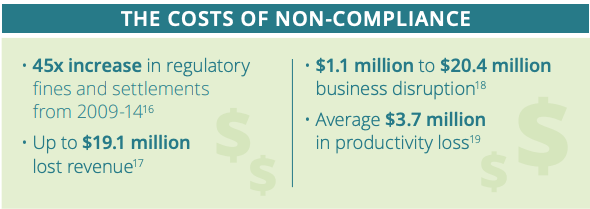

The Costs of Non-Compliance are Huge and Growing

The cost of compliance failure is huge and growing. McKinsey found a 45x increase in regulatory fines and settlements over 5 years. GlobalScape estimates that non-compliance can cost a firm up to $39.22 million in lost revenue, business disruption, productivity loss and penalties. And the Institute of International Financial says compliance can cost a firm over $1 billion per year.

Meanwhile, a 2016 BBVA Research report found that financial services firms are dedicating around 10-15% of total workforce just to governance, risk management and compliance – that number has almost certainly gone up in the intervening years. In the very next sentence, the same report identified “compliance costs” and “reliance on manual processes in data management” as two of the top issues facing financial institutions.

Financial Document Templates Are Great for Disclosure Compliance, But You Have to Go Further

Faced with strict disclosure mandates, many financial firms build libraries of document templates. Each template is “pre-loaded” with all of the proper disclosures and legal language. Each advisor or broker then modifies the appropriate template, such as a Statement of Advice, on a client-by-client basis. As far as reducing non-compliance risk, this strategy is certainly a good start. But it’s not enough on its own.

The problem is that an average-size financial services firm may produce thousands of pages of client-facing documents every week. In the process, important disclosures may be accidentally modified or removed entirely. What’s more, the sheer volume of data and information in each document may obscure problematic or even predatory advice.

Many firms rely on spot-checks and keyword searches to confirm disclosure compliance and ensure that their advisors are working in each client’s best interests. But this process is slow, costly and unreliable.

Consider this: Looking for individual keywords may return hundreds of irrelevant matches littered through a document. Searching for whole phrases may miss where a disclosure has been truncated or deleted. And how can you use keywords to search for bad advice?

Document templates are a start. But you have to go further.

This is where Regulatory Technology (RegTech) comes into play.

Quick Context: What is Regulatory Technology? and Why Do Many “AI for Regulatory Compliance” Tools Fall Short?

Regulatory Technology (RegTech) is a category of systems that help companies comply with government regulations. For example, solutions like NetGuardians help companies with identifying, tracking and managing fraud incidents.

The RegTech market is hot. Between 2012 and 2017, RegTech companies raised $2.3 billion in funding, according to CBInsights. And ComplyAdvantage reports that the automation of due diligence is at the forefront of the RegTech revolution. But they caution that custom-fitting is key. Indeed, our own research supports the idea that one-size-fits-all RegTech solutions are, by their nature, more likely to fail.

The truth is, traditional data analytics tools often can’t handle legal, financial and and medical documents. In short, many RegTech tools don’t have the technology they need to parse the structure and content of regulatory documents. As a result, disclosure compliance systems may leave behind valuable data or overlook important context. (More info in this white paper)

Story Time: A Financial Disclosure Compliance Monitoring Solution That Empowers, Not Replaces, Human Auditors

An Australian financial services company came to Lexalytics for help reducing the time they spent auditing hundreds of pages of Statements of Advice (SoAs). Regular contract analysis tools couldn’t be customized to do exactly what they wanted. And costly failures of other large-scale AI systems had made them wary of entrusting millions to one of the Big Tech companies.

So, rather than building a high-cost, high-risk “AI for disclosure compliance,” Lexalytics focused on improving the Australian firm’s existing process.

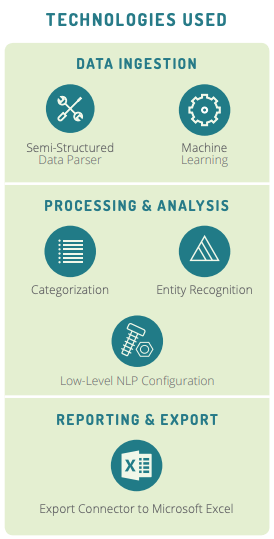

First, we trained our semi-structured data parser to understand the underlying structure of Statement of Advice documents. This included teaching the parser how to identify where sections begin and end, such as Scope of Advice and Duty of Disclosure portions.

Then, we built a custom natural language processing configuration to extract and analyze entities and other text elements. In an SoA, important entities are things like recipients, needs, goals, product recommendations, risk attitude and the actual disclosure statements.

Finally, we built a connector to structure and export the resulting data into a simple spreadsheet. (Then, based on user feedback, we made a few tweaks to how the data is organized and displayed.)

Using this system, the firm’s auditors can see at a glance whether proper disclosures were made across hundreds of SoA documents, and even where an advisor’s recommendations may go against their client’s stated goals and risk attitude. This substantially lowers their time spent on SoA review, reduces their non-compliance risk, and helps them demonstrate disclosure compliance whenever needed.

(Learn more about the process we followed for building this “semi-custom” regulatory compliance application.)

How to Build a Better Regulatory Compliance Solution

Regulatory compliance as a field varies by industry, by country, and even by company. This means that every compliance challenge is unique to some degree.

What’s more, the nature of the documents involved in regulatory compliance means that to build an “AI for regulatory compliance,” you need more than just AI. In fact, you need a combination of semi-structured data parsing, natural language processing, and machine learning. (More on why that is in this paper.)

Of course, not every RegTech system will necessarily need all three technologies at the same time. Our financial services disclosure compliance monitoring solution, for example, only uses semi-structured data parsing and natural language processing. (Of course, the NLP itself involves a lot of machine learning.)

Together, these factors mean that traditional data analytics techniques and one-size-fits-all compliance tools will often, by their very nature, fall short.

To really solve regulatory compliance problems, the most important thing is to choose a solution provider who combines the following characteristics:

- Has all three of these technologies at their disposal (semi-structured parsing, NLP, and machine learning)

- Can demonstrate that they know how, and where, to use them (and when not to use them)

- Demonstrates a proven methodology for building a system that’s custom-fit to your unique needs

Feel free to contact us if you’d like to discuss your own regulatory compliance challenges and how Regulatory Technology could help reduce your costs and risk.